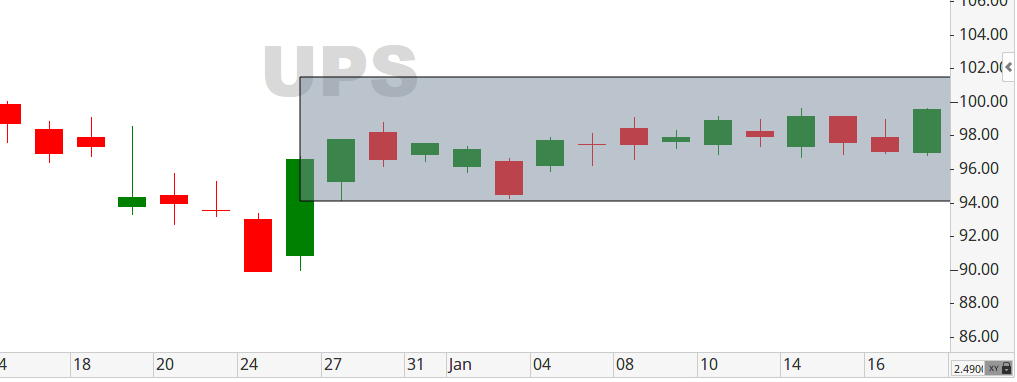

Trading Range & Consolidation (UPS).

Sometimes, it's best NOT to trade!

As Traders, we want to trade. We NEED to trade.

But, we can’t and we shouldn’t ALWAYS trade.

Exercising restraint is a learned trading skill that only comes from understanding that our trades will not always end with a positive profit curve! Learning this Money Management skill is a survival necessity; but, how do we know when it should be put in use? How do we know that maybe, for today, we should go to the beach?

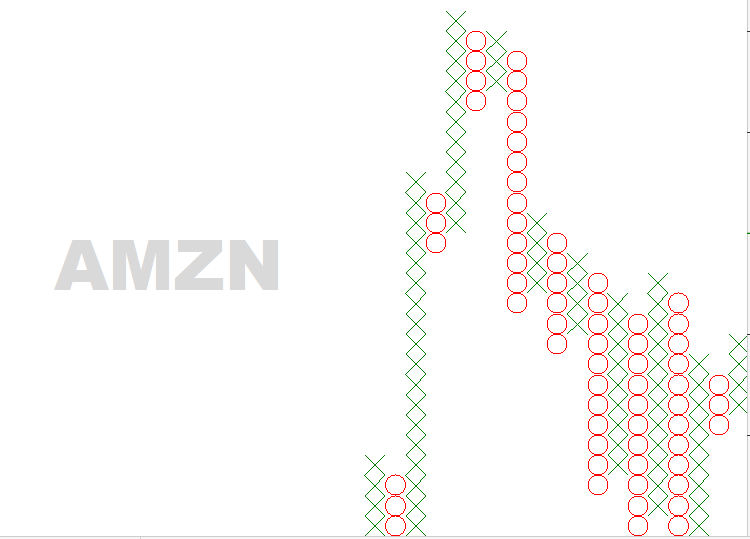

Let’s look at United Parcel Service’s (UPS) chart for clarity.

As of January 17th – we notice that (UPS) had been in downward trend for the entire month of December. And as astute traders, if you looked at the chart prior to today, you would have wanted to be prepared to take advantage of this possible reversal (as it presented itself on December 26th). Doing so, though, would not have been in our best interest. It would have tied up our available cash and might have provided us with considerable angst as we wondered IF and WHERE to exit our position.

Clearly, (UPS) has been in a consolidation period where prices seem to be stagnant and change little in price. This narrow trading range, after a few days, should have been our signal to exit and find better opportunities elsewhere. Regardless, if you are looking at a similar chart, you will know not to trade it if volatility is what you are seeking! Notice the highlighted rectangular box and how it shows a cramped trading range and ugly consolidation. Frankly, as a trader, it screams to me - “LEAVE NOW.” The question is: HOW do you know NOT to enter a trade? HOW do you know how much time to give it BEFORE exiting your position? I can help you answer that through consultation; contact me today!

Like what you read?

Then, subscribe to our Newsletter for more Market observations and analysis!